Shares, ETFs, investment funds and certificates in one app

Raiffeisen mobile investing offers the possibility to invest in more than a thousand investment instruments directly from your mobile phone.

Filter of investment products

Don´t know what investment to pick? Use the investment products filter to create an investment portfolio of your choice.

One-time or regular investments starting at 5 euro

You need only 5 euro to start investing with the Raiffeisen mobile investing. You decide on the desired amount and term of your investment.

Mobile app overview

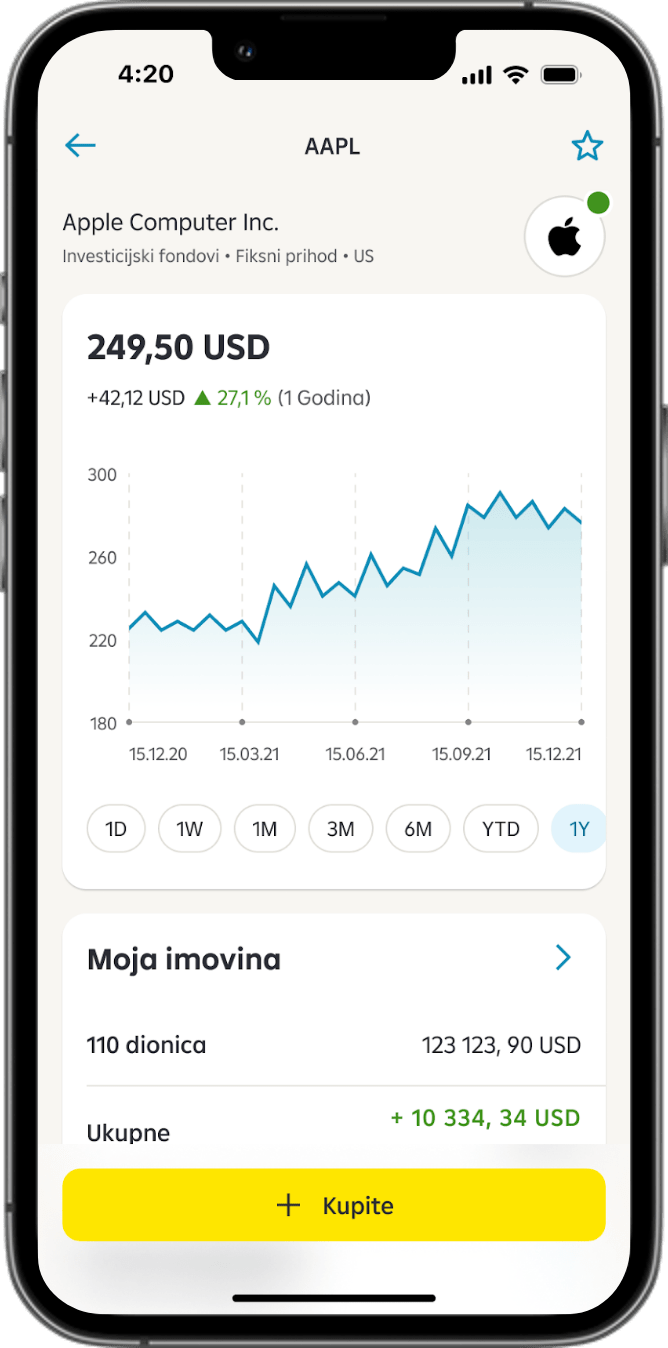

Below is the overview of the new mobile application Raiffeisen mobile investing.

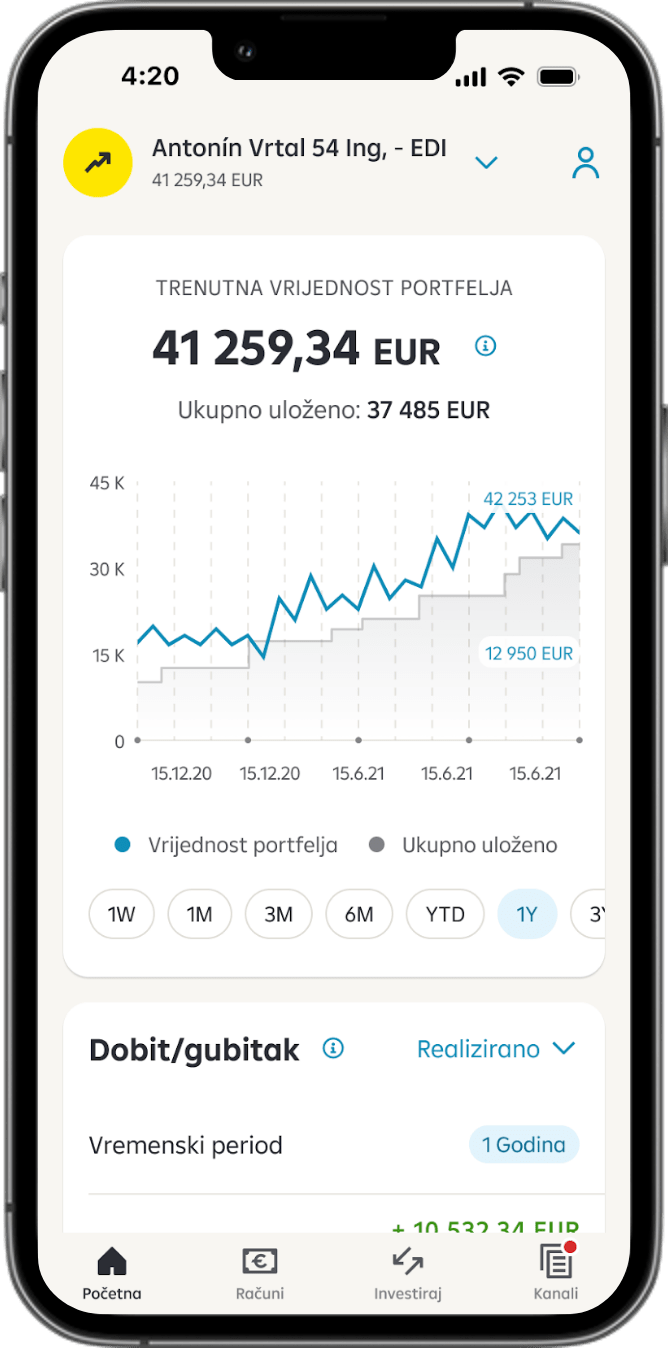

Balance of your investments is clearly shown on the main screen. The graph shows the current value of your portfolio against the total investment.

Below on the main screen, you can find a list of assets in your portfolio or information related to your regular investments.

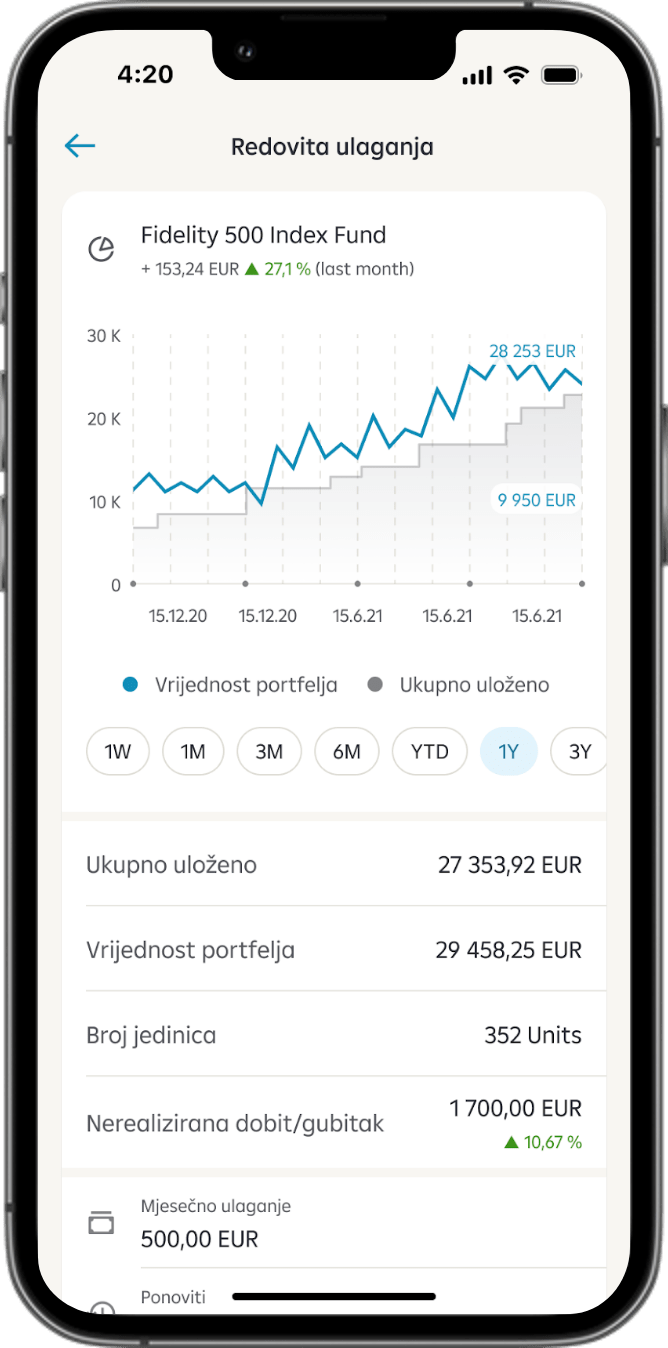

You can appreciate your money simply by regular investments.

All you need to do is choose how often and how much you will put aside. In the regular investments overview, you can see the current value of your investments, how much has already been invested as well as the current profit/loss.

The detailed product overview shows a graph with value development. The overview displays information about the investment product, the issuer, or the last known price. Product documentation is available for each investment product.

Notification for investors

Investments in financial instruments are not bank deposits and are not insured under the deposit insurance fund. The higher the expected return, the higher the potential risk. Duration of an investment impacts the risk level. The return also fluctuates due to exchange rate fluctuations. The value of the amount invested in a financial instrument and the yield therefrom may rise or fall, and the return of the originally invested amount is not guaranteed. Past performance does not guarantee future performance. Expected performance is not a reliable indicator of future performance. Due to unpredictable fluctuations and events on the financial markets and the risk of investment instruments, the realization of a client's indicated investment goal cannot be guaranteed. Remuneration and expenses of Raiffeisenbank a.s. of the Czech Republic as agreed in the contractual documents, or remuneration and fees listed in the Price List of Remunerations and Fees of Raiffeisenbank a.s. shall be deducted from investment income. Taxation of customer´s assets always depends on the personal situation of the customer and may vary. Raiffeisenbank a.s. does not provide tax consultancy. Therefore, the responsibility arising from taxation consequences of investment lies fully with the customer. The offer may not be made to a customer defined as a US person.